A rugcheck is a process used to assess the legitimacy and safety of crypto tokens, aiming to identify potential scams known as “rug pulls”. Rug pulls are a pervasive threat in the cryptocurrency landscape, particularly within decentralized finance (DeFi). In a rug pull, developers suddenly remove all liquidity from the pool or abandon a project, akin to “pulling the rug” out from under investors. This leaves them with worthless tokens and significant losses.

This guide explores the concept of rug pulls, how to conduct a thorough rug check, and the role of tools like Rugcheck.xyz and De.Fi Scanner in mitigating risks.

Conducting a rug check involves evaluating various aspects of a token and its associated project, including:

- Token Distribution: Analyzing how tokens are allocated among holders to detect any concentration that could indicate a risk of manipulation.

- Liquidity Details: Ensuring that the token’s liquidity is locked, preventing developers from withdrawing funds abruptly.

- Contract Ownership: Verifying whether the contract ownership has been renounced, which limits the developers’ ability to alter the contract maliciously.

- Developer Transparency: Investigating the credibility and transparency of the development team to assess their trustworthiness.

- Marketing and Community Engagement: Evaluating the project’s marketing strategies and community interactions to identify any signs of unrealistic promises or aggressive promotion.

By performing a thorough rug check, investors can make more informed decisions and reduce the risk of falling victim to fraudulent schemes in the cryptocurrency space.

Understanding Rug Pulls

A rug pull is a type of scam where developers exploit a cryptocurrency project to defraud investors, typically by draining liquidity or manipulating the smart contract.

How Rug Pulls Work:

- Creation and Hype: Scammers create a token and promote it aggressively on social media platforms like Twitter and Telegram.

- DEX Listing: The token is listed on a DEX with a significant liquidity injection to appear legitimate.

- The Pull: Once enough investors buy into the project, developers drain the liquidity pool, leaving investors with worthless tokens. This abrupt action effectively removes all value from the project, often resulting in significant financial losses for those who invested.

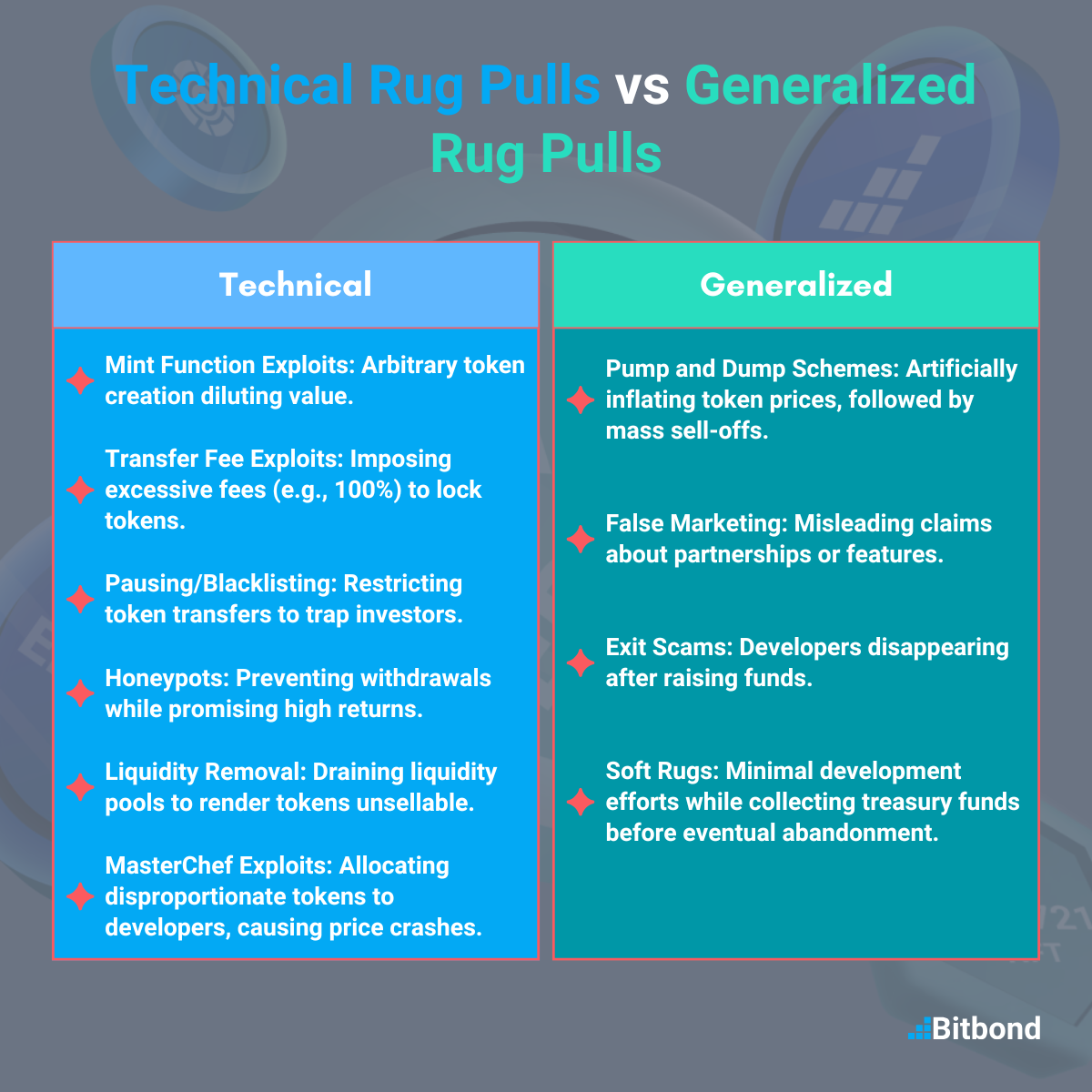

These scams can be divided into two main categories: technical rug pulls and generalized rug pulls.

Technical Rug Pulls

From a technical standpoint, rug pulls involve specific exploits of a project’s smart contract. Common techniques include:

- Mint Function Exploits: Developers embed unchecked mint functions, allowing them to create unlimited tokens and dilute the value of existing holdings.

- Transfer Fee Exploits: Contracts with excessive transfer fees (e.g., 100%) can make transactions impossible, effectively locking investors’ tokens.

- Pausing and Blacklisting: Smart contracts with controls that allow developers to pause or restrict token transfers arbitrarily, leaving investors unable to sell.

- Honeypots: Contracts designed to trap investors by preventing fund withdrawals while promising high returns.

- Liquidity Removal: Draining liquidity from decentralized exchanges, making tokens unsellable.

- MasterChef Contract Exploits: Yield farming contracts manipulated to allocate tokens disproportionately to developers, causing price crashes.

Generalized Rug Pulls

Beyond technical exploits, rug pulls can also encompass broader forms of fraud, including:

- Pump and Dump Schemes: Artificially inflating a token’s price before mass sell-offs.

- False Marketing: Misleading claims about partnerships or features that do not exist.

- Exit Scams: Developers disappearing after raising significant funds.

- Soft Rugs: Projects where developers appear active but make minimal efforts, eventually abandoning the project while collecting treasury payments.

By understanding both the technical and generalized forms of rug pulls, investors can better identify and avoid these scams.

Real-World Examples of Rug Pulls:

- The Quant Kid (2024): A young individual live-streamed the creation of a memecoin called $QUANT on Solana’s Pump.fun platform. Shortly after, he executed a rug pull by selling 51 million tokens for 128 SOL (~$30,000). Ironically, the community rallied and drove the token’s value up, with the same tokens later valued at $4 million, making the incident a cautionary tale about the volatility and risks of meme coins.

- Squid Game Token (2021): Exploiting the Netflix show’s popularity, scammers made off with $3.3 million after creating “Squid Coin.”

- AnubisDAO (2021): Promising a decentralized project, developers raised $60 million in Ether (ETH) before disappearing.

Given the complexity and variety of rug pulls, tools like Rugcheck.xyz and De.Fi Scanner are invaluable for simplifying the evaluation process. Let’s dive deeper into how they help.

The Role of Rug Checkers

Rug checkers are essential tools for analyzing cryptocurrency projects, detecting red flags, and helping investors make informed decisions. These tools assess various aspects of a project, such as token distribution, contract ownership, and liquidity.

Why Use a Rug Checker?

The volatile and unregulated nature of the crypto market makes it a prime target for scammers. Rug checkers like Rugcheck.xyz and the De.Fi Scanner act as the first line of defense, empowering users with data to mitigate risks and protect their investments.

With a clear understanding of their importance, let’s look at how specific tools like Rugcheck.xyz cater to different ecosystems, starting with Solana.

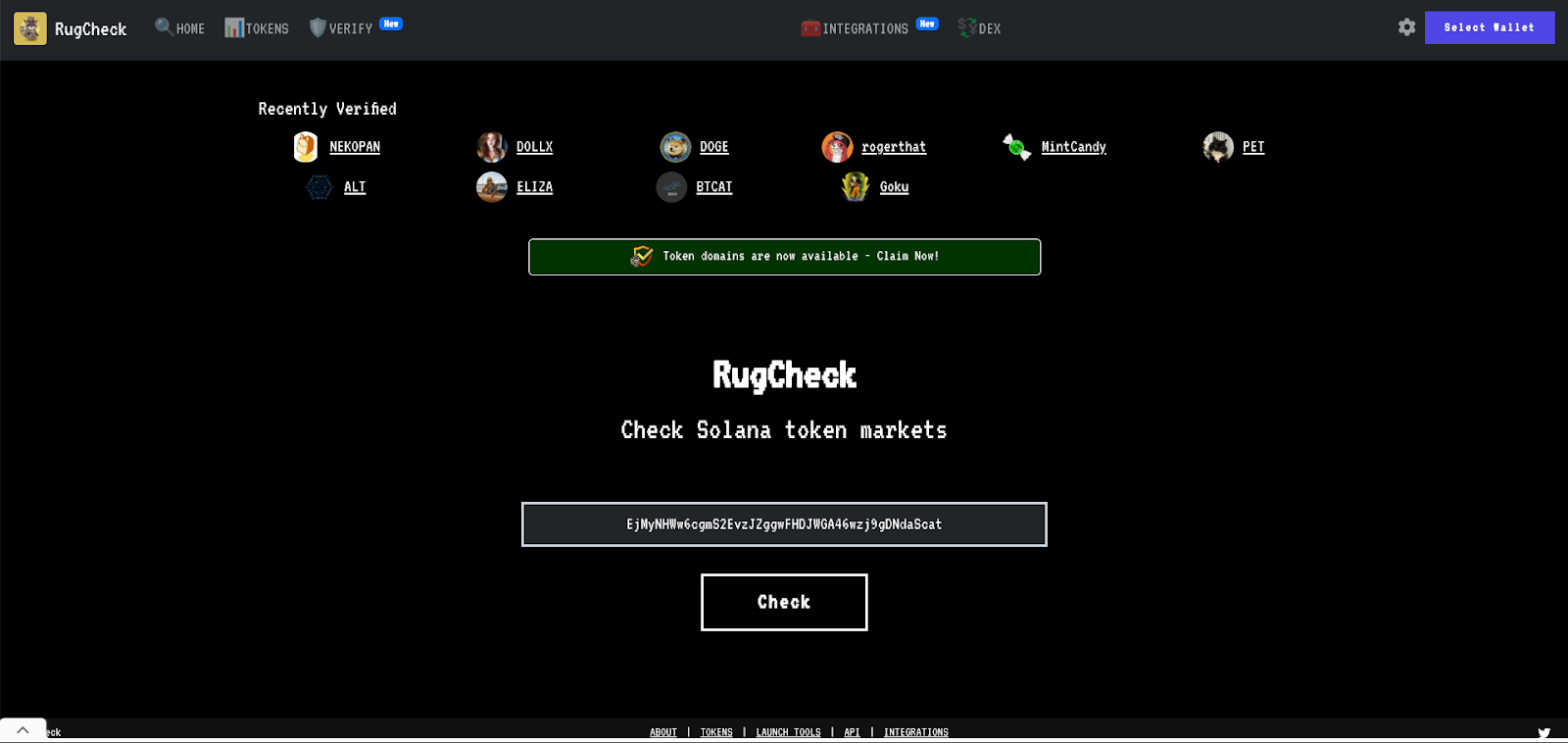

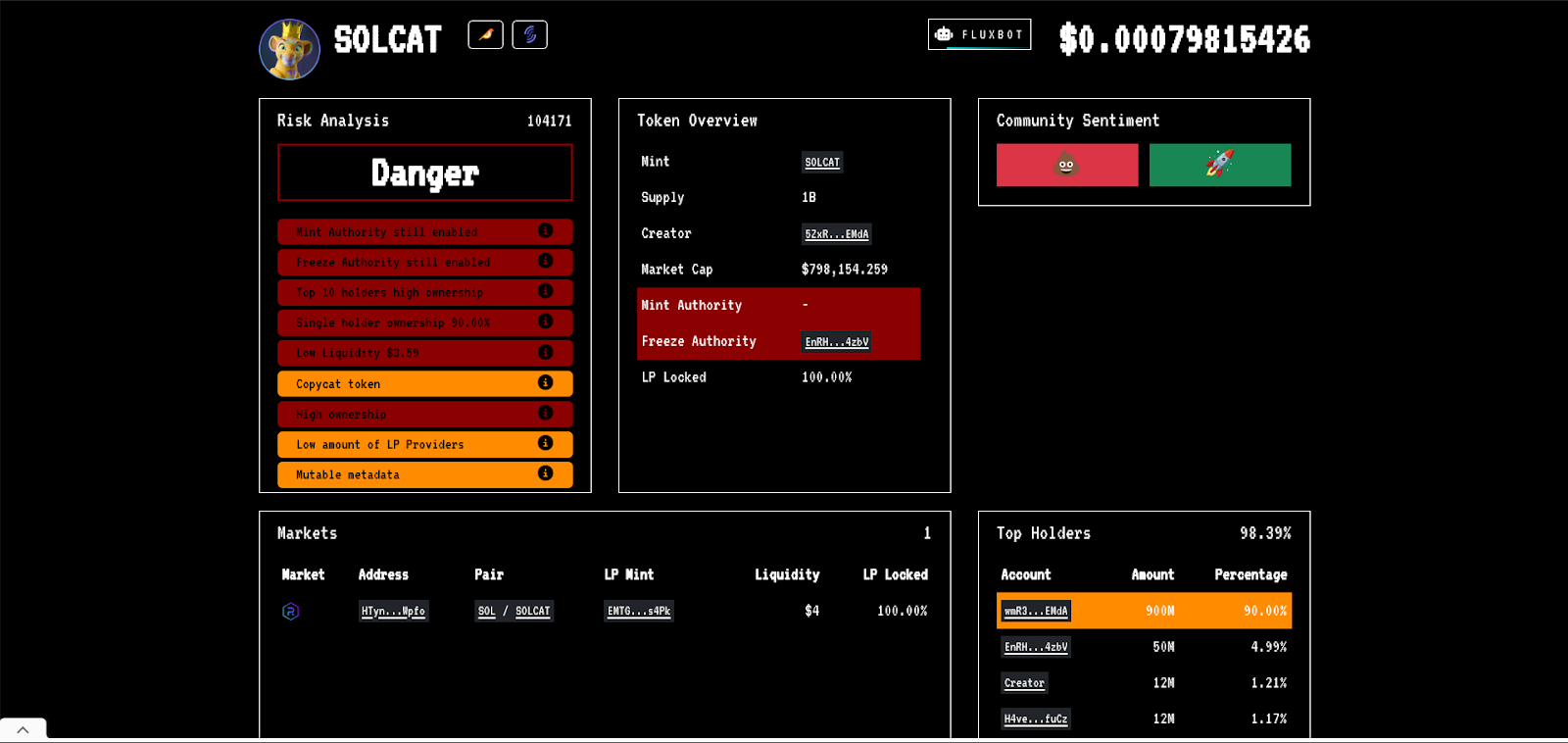

Rugcheck.xyz: A Solana-Focused Rug Checker

Rugcheck.xyz specializes in analyzing Solana-based tokens. Its straightforward interface and detailed analysis make it a valuable resource for navigating the Solana ecosystem.

How to Use Rugcheck.xyz

- Access the Tool: Visit rugcheck.xyz.

- Enter the Token Address: Obtain the Solana token’s contract address from platforms like DEX Screener or Etherscan.

- Review the Report: Rugcheck.xyz generates a detailed analysis highlighting risks such as minting permissions, liquidity issues, and ownership concentration.

- Decide on Investment: Use the analysis to evaluate the token’s risks before investing.

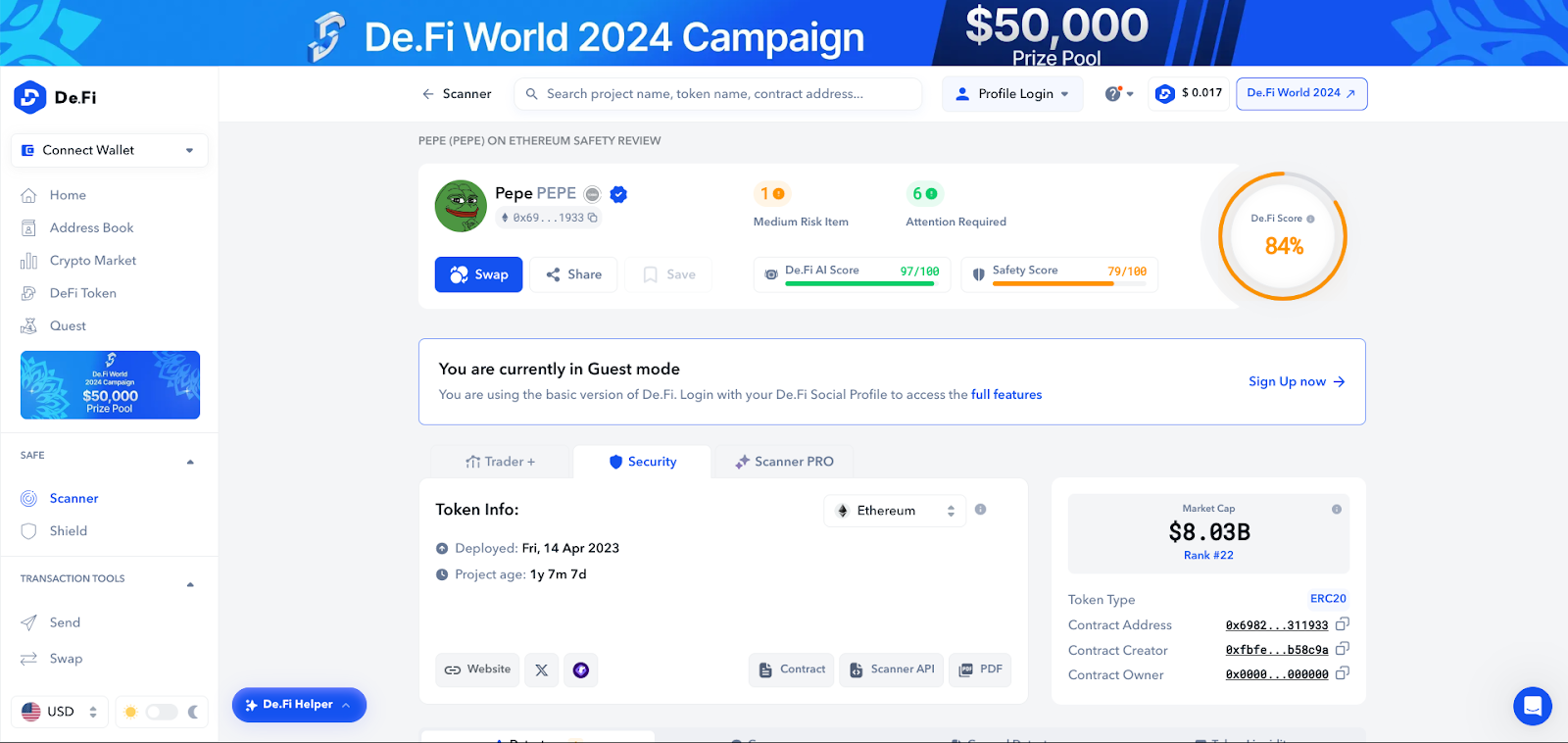

The De.Fi Scanner: A Cross-Chain Alternative

While Rugcheck.xyz is tailored for Solana, tools like the De.Fi Scanner operate across multiple EVM-compatible chains, including Ethereum, BNB Chain, Avalanche, and Polygon.

Key Features of the De.Fi Scanner

- Automated Risk Detection: Instantly generates a rug pull probability report for tokens, NFTs, and smart contracts.

- De.Fi Score: Provides an aggregated score to summarize a project’s risk level.

- Red Flag Identification: Highlights risks such as:

- Ownership Not Renounced: Developers retaining control to modify contracts.

- Minting Functions: Potential for unlimited token creation.

- High Dump Risk: Tokens concentrated in a few wallets.

- Honeypots and Liquidity Issues: Detection of traps and insufficient liquidity locks.

How to Use the De.Fi Scanner

- Identify the token’s contract address from a trusted source.

- Input the address into the scanner’s search form.

- Interpret the report, focusing on flagged issues and the overall De.Fi Score.

Beyond RugChekers: Best Practices to Avoid Rug Pulls

While tools like Rugcheck.xyz and De.Fi Scanner are invaluable, they should be part of a broader strategy that combines automated analyses with manual due diligence. To protect your investments, follow these best practices:

1. Verify Token Contract Addresses

Always double-check token contract addresses against official sources, such as the project’s website or social media accounts. Using incorrect or fraudulent addresses can lead to misleading analyses and potential losses.

2. Examine Token Distribution

Use blockchain explorers to analyze token allocation among holders. Be cautious of projects where non-team wallets hold more than 5% of the total supply unless those tokens are locked, as such concentration increases the risk of market manipulation or sudden dumps.

3. Verify Liquidity Locks

- Ensure the token’s liquidity is locked and verify the duration of the lock.

- Locked liquidity reduces the risk of developers withdrawing funds abruptly and rendering the token unsellable.

- Avoid tokens where developers maintain full control over the liquidity pool.

4. Investigate Developers

- Evaluate the credibility of the development team, even if they are anonymous.

- Look for verifiable activity on platforms like GitHub, Twitter, or LinkedIn.

- Be cautious of teams with no track record or history of involvement in other scams.

5. Assess Promised Returns

Be wary of projects offering exceptionally high returns on investment (ROI) or annual percentage yields (APY). Unrealistically high promises are often red flags for unsustainable projects or scams.

6. Examine Audit Reports

- Prioritize projects with independently audited smart contracts.

- Verify the authenticity of the audits and review the reports directly. Do not rely solely on a project’s claim of being “audited.”

7. Analyze Project Quality

Projects with low-quality websites, vague or plagiarized whitepapers, and minimal innovation often indicate a lack of effort and higher scam potential. Avoid projects that cannot clearly communicate their goals or provide tangible deliverables.

8. Monitor Wallet Permissions

Use tools like De.Fi Shield to review wallet permissions for vulnerabilities. Revoke potentially harmful permissions with a single click to enhance the security of your funds and reduce exposure to exploits.

9. Recognize Red Flags

Educate yourself about key indicators of a rug pull, including:

- Unrenounced Ownership: Retention of contract control by developers.

- Minting Functions: The ability to create additional tokens arbitrarily.

- Suspicious Transfers: Large token movements to unknown wallets.

- Locked or Restricted Trading: Contracts that limit who can buy or sell tokens.

10. Be Cautious of Stealth Mints (For NFTs)

Avoid NFT projects employing “stealth mints,” which often create artificial hype and increase rug pull risks. These tactics are designed to manipulate demand without transparent planning or execution.

By combining automated tools like Rugcheck.xyz with these proactive steps, you can significantly reduce your risk of falling victim to fraudulent schemes. Remember, no tool or strategy is foolproof; continuous vigilance and critical thinking are essential in navigating the volatile cryptocurrency landscape.

RugChekers Comparison: Rugcheck.xyz vs De.Fi Scanner

If you’re exclusively focused on Solana projects, Rugcheck.xyz is tailored for you. However, for investors operating across multiple blockchains, De.Fi Scanner provides a broader range of features and cross-chain compatibility.

| Feature | Rugcheck.xyz | De.Fi Scanner |

| Supported Chains | Solana | EVM-Compatible (ETH, BNB, etc.) |

| Automated Reports | Yes | Yes |

| Risk Indicators | Minting, Ownership, Liquidity | Ownership, Honeypots, Dump Risk |

| Additional Tools | No | Wallet Permissions Manager |

For Solana users, Rugcheck.xyz offers a focused approach. For multi-chain investors, the De.Fi Scanner provides broader functionality.

Conclusion

Rug pulls are a persistent threat in the crypto ecosystem, but tools like Rugcheck.xyz and De.Fi Scanner provide crucial protection. By combining these tools with thorough research and security best practices, investors can navigate the crypto landscape with greater confidence and reduce the risk of falling victim to scams.

Beyond tools and best practices, staying informed about new types of scams and evolving security practices is vital. Regularly educating yourself about crypto trends and engaging with trusted community resources will further enhance your ability to navigate this volatile landscape.

Remember: no tool is foolproof. Always stay vigilant and use multiple layers of security to safeguard your investments.